Businesses across Australia are striving to keep pace with a rapidly advancing digital landscape. Most are embracing innovative technologies and modernising their IT equipment, with investment in digital transformation key to meeting staff and customer expectations.

However, many of the same businesses are navigating cash flow constraints, an issue all too common given rising operating costs and ongoing economic uncertainty. This raises the question of how businesses balance IT investment imperatives with maintaining healthy cash flow - both crucial for success in a dynamic market environment.

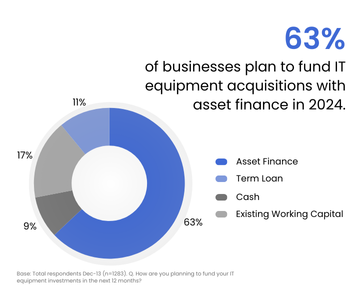

To find out, CHG-MERIDIAN, CommBank’s technology equipment finance and leasing specialist, surveyed almost 1,300 businesses about how they plan to fund IT equipment in 2024 and what factors are driving their decision-making. The study revealed that the most popular choice is asset financing, nominated by 63% of businesses.

A range of factors also influence the funding path businesses choose when acquiring IT hardware. According to businesses, the most important factors to consider are the rates and pricing associated with funding. Next on the list is the ability to swap IT equipment in and out, followed by the residual value of the technology.

Todd Fortescue, Vice President, Australia & New Zealand at CHG-MERIDIAN, says that it's clear businesses are not only looking closely at the cost of funding IT equipment in the current environment but are seeking the flexibility to upgrade as newer technology is released.

“We’re seeing most businesses opt to lease their IT equipment, but there is still a substantial number that dip into working capital or cash", Todd says. “In an environment where liquidity is under pressure, there are other technology acquisition pathways, such as leasing, that ensure that cash flow is directed to where it’s needed most.”

“Many businesses are still taking a traditional approach and seeking to own IT equipment by purchasing. While this may seem like the simplest approach, the total cost of ownership and lifecycle risks such as technology obsolescence are often ignored. As a result, the financial health and the efficiency of a business can be negatively impacted.”

What to consider when deciding how to invest in IT equipment

As businesses weigh up whether to use cash, an operating lease or an equipment loan to secure IT equipment, there are some trade-offs that must be accounted for. This is where considering the lifecycle of IT equipment and the financial and operational needs of the business are crucial.

Purchasing equipment is more expensive

From a cost perspective, purchasing equipment outright has higher upfront expenses, which can also redirect funds away from more strategic initiatives. The total cost of ownership is also important - not just the sticker price - given maintenance and disposal of ageing technology can add significantly to expenses.

“When a business chooses to lease their equipment, there’s no upfront cost, and in the example of CHG-MERIDIAN, we invest in the residual value of the equipment, resulting in a lower equipment cost than the market value during the lease term. The cost of the technology is also spread across the term, avoiding a steep initial investment and making it easy to forecast hardware spend. Given we own the equipment, there’s also no depreciation impact for the lessee,” Todd says.

Leasing models are flexible

Businesses can also align their technology landscapes with business needs, where leasing provides greater flexibility to upgrade to the latest equipment and scale up or down as requirements change. Lease terms based on the recommended useful life of the equipment enable businesses to enter a regular refresh cycle, avoid having unsecure and outdated technology and take advantage of emerging innovations.

Leasing is more sustainable than purchasing

The research shows that the sustainability impact of IT purchases was another key decision driver for businesses. This can be particularly relevant when disposing of a business's technology. Here, the onus is on businesses to ensure they are responsible and reducing e-waste.

“We’re seeing more businesses adopting circular practices as part of their own plans to reduce carbon emissions and waste. This is something CHG-MERIDIAN is committed to, and at the end of a lease term, we refurbish and remarket used devices to give them a second life, avoiding ewaste and mitigating carbon impact.” Todd says.

While there is no one-size-fits-all approach to securing the technology equipment your business needs, there are many advantages to choosing an operating lease model over a chattel mortgage or purchasing model. From cost savings and cash flow improvements to keeping up to date with the latest technologies, there’s a strong case for businesses to consider.

Why CHG-MERIDIAN?

CHG-MERIDIAN is an internationally leading asset finance and management company that develops, finances, and manages tailored technology solutions for the IT, Industrial, and Healthcare sectors. We support our customers along the entire technology lifecycle, from procurement and use to data erasure, refurbishing, and remarketing of used equipment. All of this is underpinned by our complimentary asset management system, tesma, which provides customers with complete visibility and control over their equipment and costs.

Over 15,000 customers across 30 countries, including international corporations, public authorities, and hospitals trust us to maximise their potential.

Get in contact with us

Would you like advice that‘s personal and free of charge? Get in touch with us and discover how you can benefit from our expertise.

Contact us directly

Our team of experts are ready to help you! Get in contact now.

Todd Fortescue

Vice President of Sales, ANZ

- CHG-MERIDIAN Australia Pty Ltd

- Suite 31.02, Level 31, 1 Market Street

- 2000 Sydney

- +61 29409 8200

- info_anz@chg-meridian.com